Medical billing and coding are fundamental processes within the healthcare industry, acting as the crucial bridge that translates patient encounters into a standardized language for claims submission and reimbursement. Essentially, they are the financial backbone of healthcare operations, ensuring that healthcare providers receive appropriate compensation for the services they deliver.

While often used interchangeably, medical billing and coding are distinct yet interconnected steps. Medical coding involves meticulously extracting billable information from patient medical records and clinical documentation. This information is then transformed into specific codes representing diagnoses, procedures, and services. Medical billing, on the other hand, utilizes these codes to create and submit insurance claims to payers and generate bills for patients. The synergy between medical billing and coding is vital for the smooth operation of the healthcare revenue cycle, from the initial patient registration to the final payment for services rendered.

The complete medical billing and coding cycle can vary in duration, spanning from a few days to several months. This timeframe is influenced by factors such as the complexity of the medical services provided, the efficiency of claim denial management, and the healthcare organization’s processes for collecting patient financial responsibilities.

A solid understanding of the medical billing and coding process is paramount for healthcare organizations. It empowers providers and administrative staff to maintain a streamlined revenue cycle and secure rightful reimbursements for the delivery of high-quality patient care. This comprehensive guide delves into the intricacies of this essential process.

Decoding Medical Coding: Translating Encounters into Codes

Medical coding commences at the point of patient interaction, whether in a physician’s office, hospital, or any healthcare facility. During a patient encounter, healthcare providers meticulously document the details of the visit or service in the patient’s medical record. This documentation serves to justify the specific services, items, or procedures administered and the medical necessity behind them.

Accurate and comprehensive clinical documentation during each patient encounter is the cornerstone of effective medical billing and coding. As emphasized by AHIMA, the guiding principle for healthcare billing and coding departments is unequivocal: “Do not code it or bill for it if it’s not documented in the medical record.”

Clinical documentation is crucial for providers as it serves as the primary justification for reimbursement claims submitted to payers, particularly in cases of claim disputes. Insufficient documentation can lead to claim denials and potential financial write-offs for the healthcare organization. Furthermore, inaccurate or incomplete documentation can expose providers to investigations related to healthcare fraud or liability if they attempt to bill payers or patients for services that are not adequately supported by the medical record or are entirely absent from the patient’s data.

Once a patient’s encounter is complete, certified medical coders step in to review and analyze the clinical documentation. Their role is to translate the documented services into standardized billing codes. These codes are meticulously linked to diagnoses, procedures, charges, and professional and/or facility services.

Medical coders utilize specific code sets to ensure accuracy and uniformity in this translation process. These key code sets include:

ICD-10 Diagnosis Codes: Classifying Diseases and Conditions

Diagnosis codes are essential for detailing a patient’s medical condition, injuries, social determinants of health, and other relevant patient characteristics. The healthcare industry relies on the International Statistical Classification of Diseases and Related Health Problems, Tenth Revision (ICD-10) for capturing diagnosis codes for billing purposes.

The ICD-10 system is further divided into two key components:

- ICD-10-CM (Clinical Modification): This code set is used to classify diagnoses across all healthcare settings, from physician offices to outpatient clinics and hospitals.

- ICD-10-PCS (Procedure Coding System): This code set is specifically designed for inpatient hospital settings and is used to code procedures performed in hospitals.

ICD codes provide critical details about a patient’s condition, including the location and severity of an injury or symptom, and whether the encounter is for an initial or subsequent visit related to the condition.

The ICD-10-CM code set alone contains over 70,000 unique identifiers, reflecting the vast spectrum of medical diagnoses and conditions. The World Health Organization (WHO) is the custodian of the ICD coding system, which is adapted and used internationally in various modified formats to meet specific country needs.

CPT and HCPCS Procedure Codes: Detailing Services Rendered

Procedure codes work in tandem with diagnosis codes to provide a comprehensive picture of the healthcare encounter. They specify the services and procedures that healthcare providers performed during a patient visit. The procedure coding system is composed of two main code sets: Current Procedural Terminology (CPT) codes and the Healthcare Common Procedure Coding System (HCPCS).

The American Medical Association (AMA) maintains the CPT coding system, which is used primarily for reporting medical procedures and services to private payers. The AMA publishes annual CPT coding guidelines to assist medical coders in accurately coding procedures and services.

CPT codes are often accompanied by modifiers, which provide greater specificity about the service rendered. CPT modifiers can indicate if multiple procedures were performed, the reason for a particular service, or the precise location on the patient’s body where the procedure was carried out. The use of CPT modifiers is crucial for ensuring that providers receive accurate reimbursement for all services rendered.

While CPT codes are widely used by private payers, the Centers for Medicare & Medicaid Services (CMS) and some third-party payers mandate the use of HCPCS codes for claim submissions. The Health Insurance Portability and Accountability Act (HIPAA) also requires healthcare organizations to use HCPCS codes in certain situations.

Although there is some overlap between HCPCS and CPT codes, HCPCS codes are broader in scope and encompass non-physician services, such as ambulance transportation, durable medical equipment, and prescription drugs. In contrast, CPT codes are primarily focused on the procedures performed by physicians and other qualified healthcare professionals.

Like CPT codes, HCPCS codes also utilize modifiers to further refine the description of services.

Charge Capture Codes: Linking Services to Standard Charges

Medical coders also play a role in linking physician orders, patient care services, and clinical items to chargemaster codes. A chargemaster is essentially a comprehensive list of standard prices established by a healthcare provider organization for all services and items it offers.

Charge capture codes may include detailed procedure descriptions, time references related to the service, the departments involved in providing the medical service, and billable items and supplies used.

The CMS Hospital Price Transparency rule mandates hospitals to publicly post their chargemasters on their websites and display prices for 300 shoppable services, enhancing price transparency for patients.

In a process known as charge capture, revenue cycle management professionals leverage these chargemaster prices to negotiate reimbursement rates with payers. Coders submit these codes and corresponding charges to payers, and subsequently, providers bill patients for any remaining balances after insurance payments.

Professional and Facility Codes: Differentiating Service Types

In specific situations, medical coders also translate medical records into professional and facility codes to further differentiate the nature of services provided.

Professional codes capture and categorize services delivered by physicians and other clinical professionals, linking these services to appropriate billing codes. These codes are derived directly from the documentation within a patient’s medical record.

Facility codes, on the other hand, are used by hospitals and other healthcare facilities to account for the overhead costs associated with providing healthcare services. These codes encompass charges related to medical equipment, supplies, medications, nursing staff, and other technical components of care.

Hospitals can include professional codes on claims when a physician directly employed by the hospital provides clinical services. However, if a non-hospital-employed provider utilizes the hospital’s facilities and supplies, the facility cannot bill for professional services.

Integrating professional and facility coding processes into a unified platform can significantly streamline operations for hospitals. Furthermore, leveraging technology such as computer-assisted coding (CAC) solutions can accelerate the medical coding process and improve coding accuracy and efficiency, as highlighted by AHIMA.

Medical Billing: From Claims to Collections

Medical billing is the subsequent process that follows medical coding, where healthcare organizations generate and submit claims to payers and bill patients for their financial responsibility. While medical coding is focused on translating clinical information into codes, medical billing encompasses the administrative and financial operations necessary to secure payment for healthcare services.

Front-End Medical Billing: Initiating the Revenue Cycle

The medical billing process actually begins at the front-end, when a patient initially registers at a healthcare office or hospital and schedules an appointment.

During pre-registration, administrative staff members play a vital role in ensuring a smooth billing process. They are responsible for:

- Ensuring patients complete all necessary registration forms.

- Verifying patient demographic information, including home address and contact details.

- Confirming the patient’s insurance coverage and details.

- Obtaining any required prior authorizations from insurance providers before services are rendered.

- Clearly communicating patient financial responsibilities, such as copayments, deductibles, and coinsurance.

Ideally, during the front-end process, the healthcare office or hospital can collect any applicable copayments from the patient at the time of their appointment.

Once a patient completes their appointment and checks out, the medical coding process commences, utilizing the medical records generated during the encounter to create billable codes.

Back-End Medical Billing: Claim Creation and Submission

In the back-end medical billing process, medical coders and billers collaborate to create a “superbill,” as defined by AAPC.

The superbill is a comprehensive, itemized document that serves as the foundation for generating insurance claims. It typically includes the following key information:

- Provider Information: Details about the rendering provider, including name, location, signature, and National Provider Identifier (NPI). It also includes information for ordering, referring, and attending physicians, if applicable.

- Patient Information: Patient demographics such as name, date of birth, insurance details, date of first symptom, and other pertinent patient data.

- Visit Information: Specific details about the healthcare encounter, including the date(s) of service, relevant procedure codes, diagnosis codes, code modifiers, time spent with the patient, units of service, quantity of items used, and authorization information.

Providers may also include additional notes or comments on the superbill to provide further justification for medically necessary care. Billers then extract information from the superbill to prepare formal insurance claims.

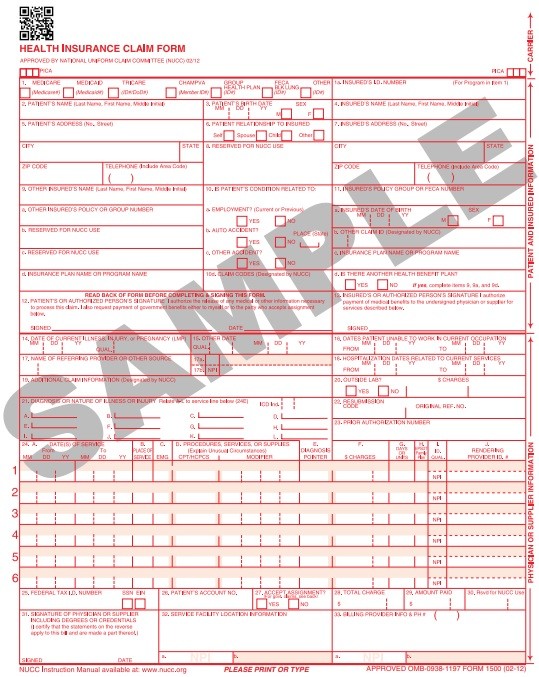

Billers primarily work with two standardized claim forms:

- CMS-1500 form: Developed by Medicare, this form is used by non-institutional healthcare facilities, such as physician practices and clinics, to submit claims for services.

- CMS-1450 form (UB-04): Also created by Medicare, this form is used for claims from institutional facilities, primarily hospitals and inpatient facilities.

Private payers, Medicaid, and other third-party payers may utilize different claim forms based on their specific reimbursement requirements. However, many payers have adopted the CMS-generated forms or have developed their own forms based on the CMS format, promoting standardization within the industry.

Before claim submission, billers perform a crucial step known as “claim scrubbing.” This involves meticulously reviewing claims to ensure that all necessary procedure, diagnosis, and modifier codes are present, accurate, and appropriately linked. They also verify the completeness and correctness of patient, provider, and visit information.

Once claims are scrubbed and deemed accurate, back-end medical billers transmit them to payers. Under HIPAA regulations, providers are mandated to submit their Medicare Part A and B claims electronically using the ASC X12 standard transmission format, commonly referred to as HIPAA 5010.

Many other payers have followed Medicare’s lead by requiring electronic claim submissions, recognizing the efficiency and cost savings associated with electronic claims management. According to CAQH, widespread adoption of electronic claims management could save healthcare providers approximately $9.5 billion annually.

The shift towards remote work during the COVID-19 pandemic further accelerated the adoption of electronic claims management systems by both payers and providers.

Medical billers can submit claims directly to the payer or utilize a third-party organization known as a clearinghouse. A clearinghouse acts as an intermediary, receiving claims from providers and forwarding them to the appropriate payers. Clearinghouses also offer claim scrubbing and verification services, helping to minimize errors and ensure accurate claim submissions.

Clearinghouses are particularly beneficial for providers who may not have access to comprehensive practice management systems capable of electronic claim submission. By utilizing clearinghouse services, providers can reduce potential errors associated with manual claim processes.

Once a claim is received by the payer, the adjudication process begins. During adjudication, the payer evaluates the provider’s claim and determines the amount they will reimburse the provider. Payers have the option to accept, deny, or reject claims based on their assessment.

Payers communicate their adjudication decisions back to the provider organization through Electronic Remittance Advice (ERA) forms. These forms detail which services were approved for reimbursement, indicate if additional information is required for processing, and provide reasons for claim rejections or denials. Based on the reasons for rejection or denial, billers can make necessary corrections and resubmit the claims for reconsideration.

Upon receiving reimbursement for a successfully adjudicated claim, medical billers generate statements for patients. Typically, providers will bill patients for the difference between their chargemaster rate and the amount reimbursed by the payer, representing the patient’s out-of-pocket responsibility.

Traditionally, patients receiving care from out-of-network providers were responsible for negotiating out-of-pocket expenses with their health plans. However, the No Surprises Act, which took effect on January 1, 2022, introduced significant changes to protect patients from surprise medical bills. Under this act, providers are now required to submit claims to the health plan for out-of-network services to determine if the payer will provide coverage.

The No Surprises Act mandates that providers comply with new claim submission requirements and engage in communication with out-of-network plans. Payers and providers are given a 30-day period after claim submission to negotiate the payment amount for a surprise bill. If they are unable to reach an agreement, they must proceed through an independent dispute resolution process to determine the final payment rate.

The final stage of medical billing involves patient collections. Medical billers are responsible for collecting patient payments and submitting the revenue to accounts receivable (A/R) management for tracking and posting.

Some patient accounts may become categorized as “aging A/R,” indicating that patients have not paid their financial responsibility, typically after 30 days. Medical billers are responsible for following up on aging A/R accounts to remind patients of their outstanding balances and ensure the organization receives the owed revenue.

Revenue cycle management automation has proven to be a valuable tool for enhancing A/R management efficiency in healthcare practices, improving staff productivity and streamlining workflows.

Once a medical biller receives the total balance of a patient’s financial responsibility and the payer reimbursement for a claim, the patient account can be closed, and the medical billing and coding cycle for that encounter is concluded.

COVID-19’s Impact on Medical Billing and Coding Practices

The COVID-19 pandemic brought about significant shifts and adaptations within medical billing and coding processes.

Notably, in 2020, electronic claims management adoption experienced a 2.3 percentage point increase across both the medical and dental industries. In the medical sector, this surge in electronic transactions encompassed eligibility and benefit verification, prior authorization requests, claim submissions, claim status inquiries, claim payments, and remittance advice.

Medical billers and coders faced the challenge of rapidly adapting to new codes and reimbursement policies in response to the emergence of the novel coronavirus.

In March 2020, the WHO introduced the first ICD-10 code specifically for COVID-19. Since then, numerous new ICD procedure codes related to the virus have been implemented, along with substantial revisions to CPT and HCPCS codes to accurately document COVID-19 diagnoses and related conditions.

CMS also implemented a significant change to the Medicare Physician Fee Schedule during the pandemic, which directly impacted medical billers and coders. The revised guidelines allowed physicians to select evaluation and management (E/M) codes based on the total time spent on the date of the patient encounter. This shifted away from the previous reliance on patient history or physical exams as the primary determinants for appropriate E/M coding.

Medical billing and coding are indispensable components of the healthcare revenue cycle. Ensuring the efficient and accurate operation of the medical billing and coding cycle is essential for healthcare providers to receive timely payments for the services they deliver, thereby sustaining their ability to provide ongoing care to patients and maintain the financial health of their organizations.

This article was originally published on June 15, 2018.

Next Steps

High-acuity inpatient stays up 41%, likely result of upcoding