The landscape of healthcare is constantly evolving, and with it, the complexities of medical billing and coding. For patients seeking immediate medical attention outside of a traditional emergency room, urgent care centers have become increasingly vital. Understanding how these visits are coded, specifically using the level 1-5 system, is crucial for both healthcare providers and patients alike. This article delves into the intricacies of level 1-5 coding in outpatient settings, with a spotlight on urgent care centers, examining the trends, cost implications, and factors driving changes in coding practices.

What is Level 1-5 Coding and Why Does It Matter?

In outpatient healthcare settings like physician offices, emergency rooms, and urgent care centers, the complexity of a patient visit is categorized using a system of Evaluation and Management (E/M) coding. This system, based on Current Procedural Terminology (CPT) codes developed by the American Medical Association (AMA), ranges from level 1, representing the least complex visits, to level 5, for the most complex cases. These coding guidelines are endorsed by the Centers for Medicare and Medicaid Services (CMS).

The level assigned to a visit dictates the reimbursement rate from insurers to healthcare providers. Level 1 visits are typically for straightforward issues requiring minimal time and medical decision-making, while level 5 visits involve complex medical scenarios demanding extensive time, resources, and intricate decision-making processes. Consequently, higher complexity levels translate to higher charges for services, impacting both insurance payouts and out-of-pocket expenses for patients, particularly those with deductibles or co-insurance plans.

The Rising Tide of Complexity: Trends in Outpatient Coding

Over the past two decades, a noticeable shift has occurred in outpatient coding practices across the United States. Data reveals a consistent trend towards billing for higher complexity visits in physician offices, emergency departments, and, notably, urgent care centers.

Looking at the broader outpatient setting, a significant change is evident from 2004 to 2021. The proportion of level 3 claims, once the majority at 60% in 2004, decreased to less than half (45%) by 2021. Conversely, level 4 claims nearly doubled, rising from 19% to 37% during the same period. Even during the COVID-19 pandemic in 2020 and 2021, this trend persisted, with level 5 claims continuing their upward trajectory, reaching 6% of all claims in 2021.

Emergency Department: Level 4 and 5 Claims Take the Lead

Emergency departments have witnessed the most dramatic changes in coding complexity. In 2004, level 3 claims were the most frequent. Fast forward to 2021, and level 4 has become the dominant code, accounting for over a third (35%) of all claims. Level 5 claims have also seen a significant surge, tripling from 8% in 2004 to a quarter of all emergency department claims by 2021.

This increase in emergency department complexity might be partially attributed to the growth of urgent care centers. As urgent care facilities handle less severe cases, emergency rooms may be increasingly focused on patients with more acute and complex medical needs.

Physician Offices: Level 4 Claims on the Rise

Physician offices also reflect the trend towards higher complexity coding, albeit less pronounced than in emergency departments. While level 3 claims remain the most common in physician offices, their share decreased from 61% in 2004 to 48% in 2021. Simultaneously, level 4 claims have grown significantly, increasing from approximately 20% of office visit claims in 2004 to over 38% by 2021.

Urgent Care Centers: The Shift Towards Level 4

Urgent care centers exhibit a distinct pattern in coding complexity. Level 3 and 4 claims together constituted 76% of urgent care claims in 2004, escalating to 93% by 2019. Level 4 claims experienced substantial growth, rising from less than a quarter (21%) of urgent care claims in 2004 to nearly half (49%) before the pandemic. Interestingly, lower complexity claims (level 1 and 2) became increasingly rare in urgent care settings during this period, with level 1 claims practically disappearing by 2019.

The pandemic years (2020 and 2021) introduced some fluctuations, with a slight increase in level 1-3 claims and a decrease in level 4 claims in urgent care. These changes may reflect shifts in healthcare seeking behavior, modifications in billing practices, or a combination of factors related to the pandemic.

Complexity Creep: Even Simple Diagnoses Show Higher Coding Levels

The trend of increased coding complexity is not limited to overall visit patterns; it extends to specific, common diagnoses. Even for conditions like urinary tract infections (UTIs) and headaches, which are not typically associated with increasing severity over time, higher coding levels are becoming more prevalent.

For urinary tract infections, level 3 claims were the majority in both emergency departments (54%) and physician offices (67%) in 2004. However, by 2021, level 3 claims represented only 31% of emergency department UTI claims and 57% of office UTI claims. Alarmingly, in emergency departments, level 5 claims for UTIs reached 1-in-5 visits by 2021.

Similarly, for headaches, level 3 claims were the most common in 2004 in both physician offices (58%) and emergency departments (41%). By 2021, level 4 claims had become the majority in both settings. In emergency departments, level 5 claims for headaches more than tripled from 2004 to 2021.

The Price of Complexity: Cost Implications

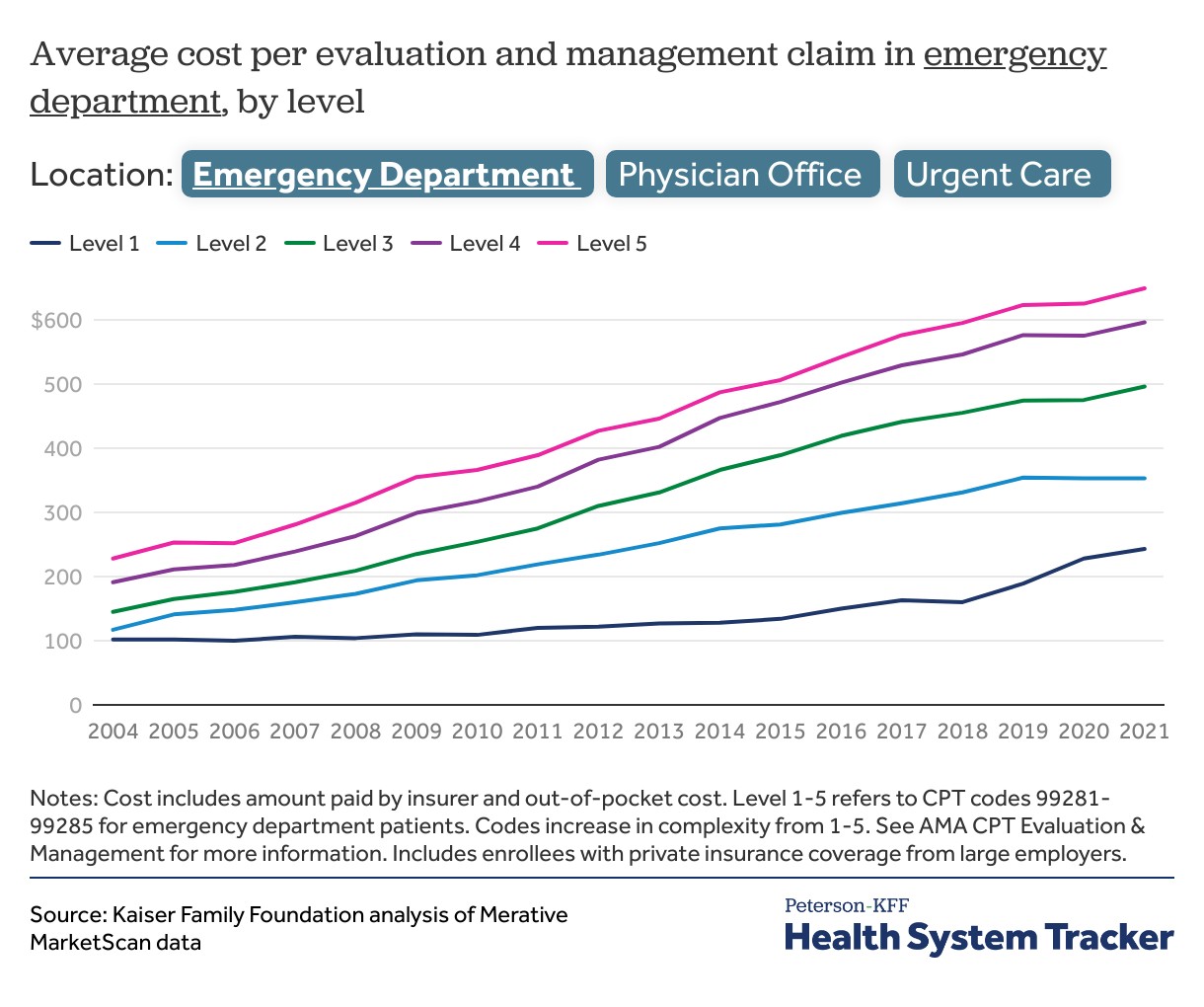

The rise in coding complexity directly translates to increased healthcare costs. In 2021, the average cost for evaluation and management services in emergency departments was nearly five times higher ($556) than in physician offices ($125). Urgent care centers fell in between, with an average cost of $147 per visit.

Furthermore, the cost disparity between different coding levels is most pronounced in emergency departments. A level 5 emergency department claim, on average, costs over $400 more than a level 1 claim. This cost escalation is not uniform across all settings.

Analyzing the growth in costs from 2004 to 2021 reveals that emergency departments experienced the most significant relative cost increases across all coding levels. Level 1 emergency department claims saw a 138% cost increase, while level 5 claims surged by 185%. In physician offices and urgent care centers, the cost gap between lower and higher complexity claims also widened, with higher level claims experiencing more substantial cost growth.

Decoding the Drivers: Why is Coding Complexity Increasing?

Several factors could be contributing to the observed increase in outpatient coding complexity. One potential explanation is upcoding, the practice of inappropriately billing for higher complexity services to receive greater reimbursement. Concerns about upcoding have been raised across various healthcare settings.

However, other factors may also be at play. Increased patient acuity could be a contributing factor. It’s possible that patients presenting to outpatient settings, including urgent care centers, are genuinely sicker or have more complex medical conditions than in the past. Changes in services provided during visits could also justify higher coding levels. For instance, advancements in diagnostic testing or treatment protocols might lead to more resource-intensive visits. Additionally, a shift in care from inpatient to outpatient settings for certain conditions could result in a higher complexity mix in outpatient facilities.

While the average age of the insured population studied remained stable, the study acknowledges limitations in assessing overall health status changes. Therefore, it’s difficult to definitively attribute the increase in coding complexity solely to increased clinical acuity or to rule out other contributing factors.

Impact on Healthcare Spending: Billions at Stake

The cumulative effect of increased coding complexity is substantial. If visit coding levels in 2021 had remained at the same distribution as in 2011, outpatient evaluation and management spending in physician offices and emergency departments would have been approximately 4% lower. Extending the comparison to 2004 levels reveals even more significant potential cost savings – 11% lower emergency department spending and 10% lower office spending in 2021.

The majority of these potential cost savings are linked to physician office visits simply because they represent a larger proportion of overall outpatient evaluation and management spending. While urgent care centers constitute a smaller segment of outpatient spending, the trend towards higher complexity coding within these facilities also contributes to the overall increase in healthcare expenditures.

Conclusion: Addressing Complexity and Cost in Outpatient Care

The data clearly indicates a consistent trend towards higher complexity coding for outpatient visits across emergency departments, physician offices, and urgent care centers. This trend has significant implications for healthcare spending, potentially adding billions to national healthcare expenditures. While the precise drivers behind this complexity creep remain multifaceted and require further investigation, the financial impact is undeniable.

For patients, particularly those with cost-sharing arrangements like co-insurance and deductibles, this trend translates to higher out-of-pocket expenses. Addressing the increasing complexity of outpatient coding is crucial for controlling healthcare costs and ensuring affordability for patients. Further research is needed to disentangle the various factors contributing to this trend, including billing practices, changes in patient acuity, and the evolution of outpatient service delivery models. Understanding these dynamics is essential for developing effective strategies to manage and optimize healthcare spending in the evolving landscape of outpatient care, especially within the rapidly growing sector of urgent care centers.

Methods

This analysis leverages data from the Merative MarketScan Commercial Database, encompassing claims data from large employer-sponsored health plans. The dataset included claims for nearly 14 million individuals, representing approximately 17% of the large group market, spanning from 2004 to 2021. Statistical weights were applied to ensure the MarketScan data was representative of the large group market population. The analysis focused on evaluation and management claims within emergency departments, physician offices, and urgent care centers, categorized by CPT codes specific to each setting (99281-99285 for ED, 99211-99215 for established office patients, and a combination of 99201-99205 and 99211-99215 for urgent care). Specific diagnoses like headache and urinary tract infections were identified using ICD-9 and ICD-10 codes. It is important to note that the analysis is limited to spending within the specified outpatient setting and does not include ancillary services billed separately or balance billing.